MonieQuest Redesign is a comprehensive initiative aimed at enhancing the user experience of a financial technology application. As the lead product designer for this project, I embarked on the task of reimagining the MonieQuest app to create a seamless and user-friendly platform for setting savings goals, tracking expenses, and managing finances effectively.

Lead Product Designer

Year

2023

8 weeks

Sketch for wireframing

Figma for interactive prototyping

Adobe XD for visual design

Zoom for usability testing

Notion for project documentation

The core objective of the MonieQuest Redesign project was to transform the existing application into a modern and intuitive bank savings app. This redesigned app was intended to empower users with a simplified and engaging way to manage their finances, achieve savings goals, and gain insights into their financial habits.

Enhanced Engagement: Users actively managed finances via savings goal achievements.

Streamlined Tracking: Expense tracking facilitated informed spending decisions.

Boosted Confidence: Personalized insights fostered financial awareness.

Smooth Goal Setting: Intuitive setup simplified allocation towards goals.

Validated Effectiveness: Testing confirmed user-friendly improvements.

Efficient Management: Integrated accounts supported holistic control.

Prudent Habits: Users adopted wiser spending practices.

Meaningful Experience: Iteration led to impactful financial empowerment.

Improved onboarding process

Increase in user retention

Increase in time spent on website

Conducted in-depth user interviews with a diverse group of participants, ranging from young professionals to families. Explored their financial habits, challenges, and aspirations through open-ended discussions.

Performed a competitive analysis of leading finance apps, including Mint, YNAB, and Acorns. Identified strengths and weaknesses in their user experiences, especially in terms of goal setting and expense tracking.

Mint:

Strengths: Comprehensive financial snapshot, budget tracking, notifications, data visualisation.

Weaknesses: Limited goal setting, complex user interface, occasional expense categorisation issues.

YNAB (You Need A Budget):

Strengths: Zero-based budgeting, envelope system, proactive expense tracking, educational resources.

Weaknesses: Learning curve, manual transactions, limited investment insights.

Acorns:

Strengths: Micro-investing, automated savings, simplified investment options, financial literacy.

Weaknesses: Limited budgeting, investment fees, savings focus.

These insights guided the development of MonieQuest, addressing the gaps to create a holistic bank savings app that caters to users' financial needs.

Prioritized features using the MoSCoW method:

Must-Have: Goal visualization, expense categories, secure account linking.

Should-Have: Financial insights, expense trends, automated savings.

Could-Have: Investment suggestions, collaborative savings goals.

Won't-Have: Complex investment analysis, advanced stock trading.

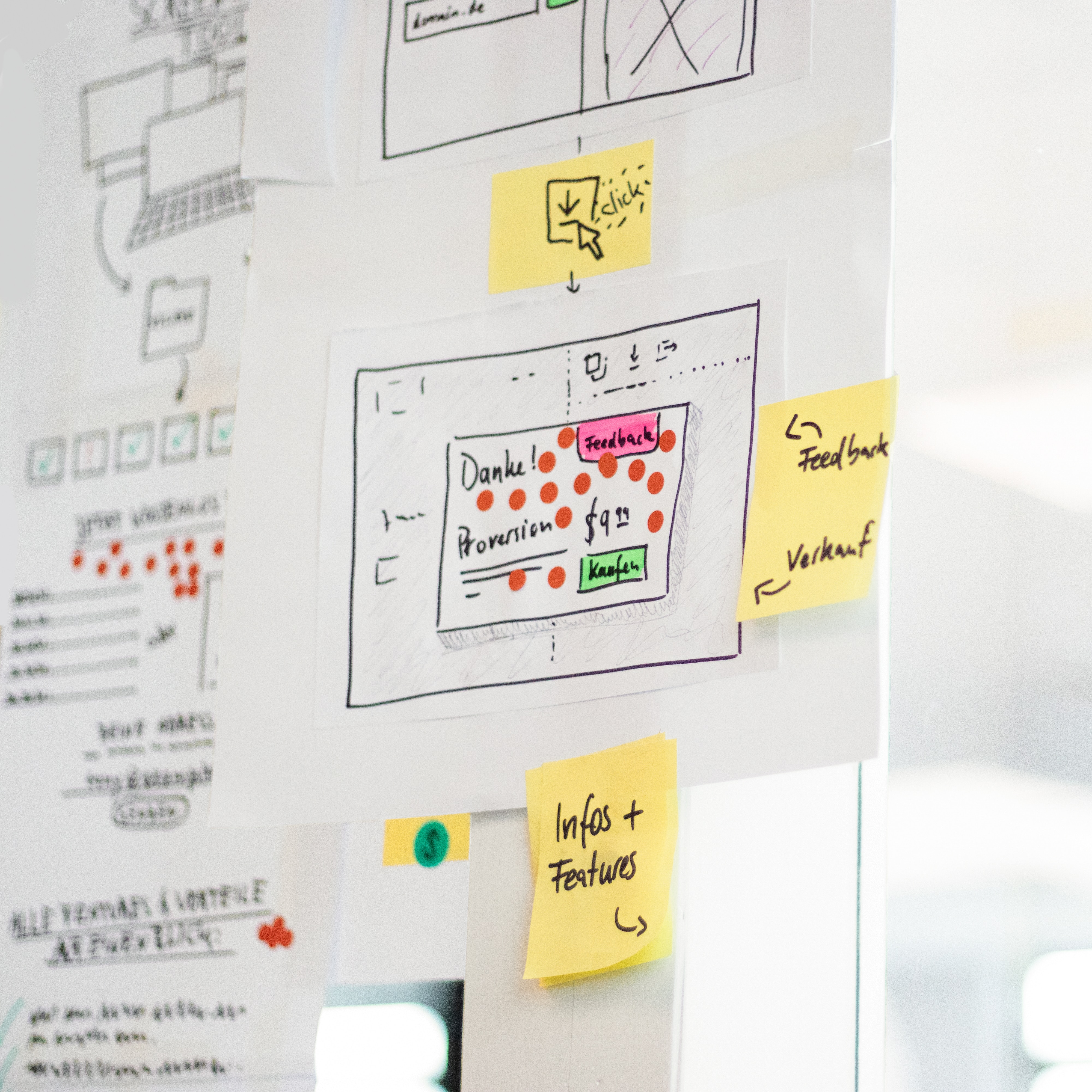

Developed wireframes that showcased the app's main screens, emphasising user flows and interactions:

Onboarding: Guided users through initial account setup and linking.

Goal Setup: Enabled users to create and customize savings goals.

Expense Tracking: Provided an intuitive interface for recording expenses.